20 Best Index Funds in India to Invest in April 2023 With Returns

Contents:

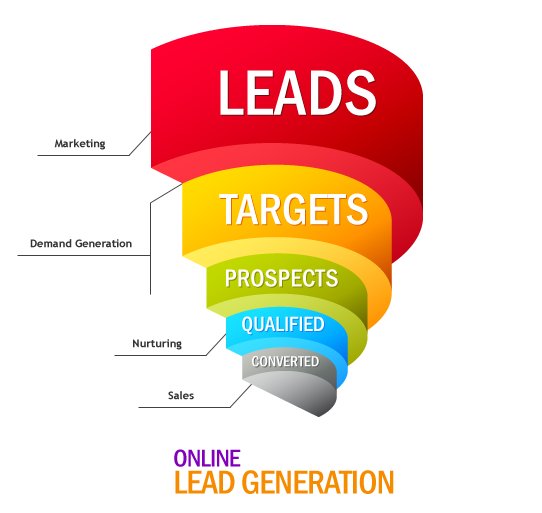

Nowadays, index funds are as accepted as fish and chips on a Saturday. There had been numerous academics and individual investors who supported the idea of index funds before John put his offering on the table for retail investors to mass adopt. Today, this passive form of portfolio making is still an underdog to active portfolio creations like mutual funds. When you invest into the Fidelity Index World fund, you are investing in more than 1500 total assets. They are made up of stocks, bonds, and funds, and include 23+ markets, as well as large and medium-sized businesses.

No individual stock makes up more than 3.1% of the fund’s assets. As you might expect, the ETF has an above-average 3.3% dividend yield. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions.

Best Index Funds to Invest in 2023

If you’re like me, you might prefer to only invest in government debt on the bonds side. Treasury Bond ETF seeks to track the Barclays Capital U.S. Treasury Bond Index, providing broad exposure to the U.S. To diversify even further with bonds, investors may opt to go outside the U.S. and invest in foreign bonds. BNDX from Vanguard tracks the Bloomberg Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index and has an expense ratio of 0.08%.

Top 10 Chit Fund Schemes in India in Chit funds are one of the most popular return-generating saving schemes in India. Despite the fact that index funds map a specific index, one should not invest blindly in one of the best index funds. Conduct your research to determine whether these funds are a good fit for your portfolio and how much you should invest in them. If you hold the fund for longer than a year, the returns you earn will be called Long-Term Capital Gains . Any amount above this is taxed at 10% without the benefit of indexation. If a stock’s weightage has increased or decreased in the index, the fund manager of an Index Fund will also replicate those changes in his fund.

Vanguard Russell 2000 ETF (VTWO)

If you invest in a fund with a 1% expense ratio, 1% of your investment will be used to cover fund costs rather than being invested to generate returns. There is no one definition of the “total U.S. stock market” when it comes to index fund investing. Many funds use different indexes and sampling strategies to construct their portfolios and to measure performance. No list of index funds is complete without the stalwart S&P 500 index. It is the most popular index to invest in, comprised of the 500 largest American companies that make up roughly 82% of the entire U.S. stock market.

It’s higher than some, but also lower than many, so it immediately makes a good first impression. However, the various institutions that regulate access to these markets are steadily liquidating offerings that give you exposure to the Russian and Chinese markets. In this guide, we cover some of those best index funds today. Trading in “Options” based on recommendations from unauthorised / unregistered investmentadvisors and influencers. If you are subscribing to an IPO, there is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment.

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Index funds are a simple and low-cost way to invest in the market and can provide investors with diversified exposure to the market. You can read How to invest in mutual funds in the Zerodha guide to understand the detailed step-by-step process of investing in mutual funds. Some people never proceed beyond collecting names of top funds because a lingering doubt about the veracity of the names always holds them back. No wonder, many investors keep visiting mutual fund forums for validation for years – even after they start investing. Investment Horizon Index funds are well-suited for long-term investors, as they provide consistent returns over time.

Mid-cap stocks are a wonderful alternative to their large-cap counterparts. They are a great option to potentially beat the powerful S&P 500. These historically perform better than larger market capitalization stocks, yet do not run the significant risk that small-cap stocks do. They are in the sweet spot that occurs when the returns are solid but the risk is not too extreme.

Schwab S&P 500 Index Fund (SWPPX)

As such, https://1investing.in/ors who haven’t made rebalancing a habit may find that their portfolios are still heavier on U.S. stocks than they should be today and lighter on bonds and international stocks. When you invest in an index fund, you are buying access to stock performance without needing to necessarily pay management fees. By comparison, mutual funds often incur management fees because they are more active and more curated.

Update your mobile numbers/email IDs with your stock brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Best mutual fund must have a fund rating above 3 stars by reliable credit agencies or companies like CRISIL or Value Research. Real estate investment trusts, or REITs, can be a great addition to any risk-averse investment portfolio. REITs tend to pay higher dividends than the typical S&P 500 stock, have lower volatility during difficult environments, and have outperformed the S&P slightly over the long run.

Considerations for investing in index funds

The fund holds virtually every public U.S. company you’ve ever heard of—and likely thousands you haven’t. Enter the Fidelity Zero Total Market Index Fund , which offers broad exposure to the entire universe of U.S. stocks and does so while offering zero expenses and zero investment minimums. Fidelity is the first mutual fund company to take the concept of low fees all the way to no fees. If you believe in the American growth story, then buying a basket of America’s biggest and most recognized companies only makes sense. As a long-term wealth builder, it’s really hard to beat the S&P 500.

It brought forth the concept of Jack Bogle, founder of liquidity ratios: сash ratio, current ratio, and so on. Investments. Bogle had studied markets, and noticed that many investors and managers of portfolios were unable to beat averages for markets in the long run. This was especially true when factoring in expenses for fund management.

- In the interest of safely combating inflation, one ETF worth a look is the Schwab U.S. TIPS ETF, which invests in an index linked to inflation-protected Treasury securities.

- As a result, index funds are the cheapest mutual funds you can invest in.

- While an actively managed fund strives to beat its benchmark, an index fund’s role is to match its performance to that of its index.

- A 0.04% expense ratio can be a small price to pay for the peace of mind inflation resistance can provide.

- Investing in any single stock, by comparison, would be theoretically more high-risk and vulnerable to a complete collapse.

- An index fund’s aim is to closely match the performance of the index it is tracking.

But now I feel pretty good about investing for the long term. Index funds are one of the most sought after mutual funds ever since the Coronavirus pandemic has taken over the world. Let us explore index funds in detail and invest in the best index funds in India. The good news is that Fidelity ZERO Total Market Index Fund has a 0.00% expense ratio. FZROX is currently available only in certain fee-based accounts offered by Fidelity, such as Fidelity Go.

You’re our first priority.Every time.

The fund’s holdings cover the entire stock market, and include a plurality of blend stocks. Whereas VOO only contains large companies, the total U.S. stock market contains roughly 18% smaller companies, known as small-cap and mid-cap stocks. Interestingly, small- and mid-caps have outperformed large-caps historically, though they are naturally slightly more risky.

At the end of the day, you have to examine your goals as an investor and what you want your portfolio to look like. After reading what I have to say about the S&P 500 fund, you may wonder why you would ever consider investing in any other ETF. The answer lies in each individual investor’s goal with their portfolio. I am 34 years old and my investment objective is wealth maximization. If you would like to get international exposure, you can invest in NASDAQ 100 Index or S&P index fund from any of the AMCs that has low expense ratio.

Best index funds in April 2023 – Yahoo Finance

Best index funds in April 2023.

Posted: Fri, 31 Mar 2023 07:00:00 GMT [source]

Some of these holdings are high dollar and sometimes even challenging to get into. It’s a simple strategy, but it’s a reliable source of income. As long as the governments and businesses don’t fail, your investment should be fairly sound.

For example, a NIFTY Index Fund invests in stocks of companies comprising the NIFTY 50 Index in the same proportion and aims to achieve a return equivalent to the NIFTY 50 Index. For example, as Reliance has a 10.3% stake in the NIFTY 50, the fund manager of a NIFTY Index Fund will build a portfolio where the weightage of stocks of Reliance company will be 10.3%. Similarly, stocks of other companies will be held in equal proportion as the index. This is a hard question to answer, as it requires a degree of nuance. But reducing the answer to a yes or a no is not helpful, as all investments are risky.

For this reason, investors looking for safety may want to take a more targeted approach, such as the iShares U.S. As its name implies, the ETF invests in all 500 companies that make up the S&P 500 large-cap benchmark index and aims to track the performance of the index over time. It has a rock-bottom 0.03% expense ratio, which means your annual investment fees will be just $0.30 for every $1,000 in fund assets.