Cocoa Prices Fall Back on Increased ICE Inventories

Contents:

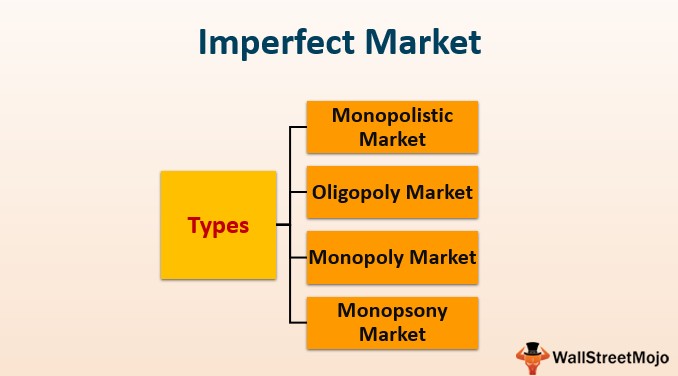

The term any distinction between buying a number of shares futures refers to futures contracts that allow traders to buy or sell a contract today to be settled at a future date. Cocoa futures are standardized, exchange-traded contracts in which the contract buyer agrees to take delivery, from the seller, a specific quantity of cocoa at a predetermined price on a future delivery date. 75% of retail investor accounts lose money when trading CFDs with this provider. The first step is to decide if you will trade the actual cocoa futures or if you will use a derivate such as a CFD. Cocoa futures require a designated futures account, the margin required is fairly high, and the leverage used in futures makes trading them a risky venture.

As of 2016, at least 29% of global cocoa production was compliant with voluntary sustainability standards. However, among the different certifications there are significant differences in their goals and approaches, and a lack of data to show and compare the results on the farm level. While certifications can lead to increased farm income, the premium price paid for certified cocoa by consumers is not always reflected proportionally in the income for farmers. Certification often requires high up front costs, which are a barrier to small farmers, and particularly, female farmers. Cocoa is used in making cocoa liquor, cocoa butter, and cocoa powder, which are used in the production of chocolate and chocolate-flavored products. The best way to play the cocoa market is by trading cocoa futures contracts on the ICE or CME.

What Is Cocoa Trading?

Cocoa, famously known for producing chocolate, is a highly traded industry. Used by ancient tribes as early as 600AD and exported to Europe from the year 1585, cocoa has a rich and interesting history. It now attracts traders almost as much as chocolate lovers, with the cocoa market reportedly worth more than $2.1 billion.1 Here are few useful things to know before you start trading cocoa.

- Past performance is not a reliable indicator of future results.

- Before understanding how it is traded on the financial markets, it is important to understand what this means.

- “Climate adaptation increases vulnerability of cocoa farmers, study shows”.

- During this time, the seeds and pulp undergo “sweating”, where the thick pulp liquefies as it ferments.

Investment opportunities present themselves in all shapes and sizes. The market you choose depends on your knowledge and on the current profitability of the market. Ensuring a well-distributed portfolio is vital to long-term success. Discover how to increase your chances of trading success, with data gleaned from over 100,000 IG accounts. One way to trade in cocoa is through the use of a contract-for-difference derivative instrument.

Other Statistical Data

Since chocolate is a discretionary item, wealth affects its demand. Do you want to know which shares are heavily dependent on the price of cocoa? Below you will see a list of well-known companies involved in producing chocolate. If prices decline, traders must deposit additional margin in order to maintain their positions. At expiration, the contracts are financially settled on the NYMEX, but physically settled on the ICE. If Western African cocoa-producing countries attain political stability and upgrade manufacturing facilities, cocoa production could increase and prices fall.

When evaluating online brokers, always consult the broker’s website. Commodity.com makes no warranty that its content will be accurate, timely, useful, or reliable. ” ‘Devastating’ impact of climate change on cocoa can’t be ignored, says Rainforest Alliance”. Cocoa beans also have a potential to be used as a bedding material in farms for cows. Using cocoa bean husks in bedding material for cows may contribute to udder health and ammonia levels .

Ivory Coast, Ghana Cocoa Regulators To Boycott Industry Meetings Over Price Dispute – ESM – European Supermarket Magazine

Ivory Coast, Ghana Cocoa Regulators To Boycott Industry Meetings Over Price Dispute.

Posted: Mon, 24 Oct 2022 07:00:00 GMT [source]

For wet processed coffee, this refers to the removal of the parchment layer while for dry processed coffee it is in reference to removing the entire dried husk of the dried cherries. Some processors may opt to have an additional stage which is polishing where any silver skin remaining on the beans after hulling is removed by machine. Farmers have to make decisions about crop production long before they will see profits from their investment. Factors including the future outlook for prices impact the quantity of production.

Investing in cocoa

Below are details of how cocoa trading has evolved over time but, in the modern era, it is predominately used in all chocolate-based products. The estimated value of the cocoa market today is $2 billion, which demonstrates just how many products rely on the cocoa bean. Because of this, the cost of the cocoa bean directly impacts the cost of all chocolate bars and other chocolate-based products globally. Today, the majority of the world’s cocoa output is processed further to create chocolate; only around a third is still used to produce cocoa powder for drinking chocolate. Either cocoa powder or cocoa butter can be obtained from the beans of the cocoa tree. In recent years, however, increasing numbers of substitutes for the latter have emerged and been used in chocolate production, leading to a strong decline in the demand for real cocoa butter.

However, you have to be cautious about leveraged instruments — while you can make more money with them, you can also lose more. Before understanding how it is traded on the financial markets, it is important to understand what this means. A soft commodity is a natural resource that is grown or produced, whereas a hard commodity needs to be extracted from the earth like gold or silver. These raw materials are used in the production of consumer goods.

Cocoa Price Forecast Is Cocoa a Good Investment? – Capital.com

Cocoa Price Forecast Is Cocoa a Good Investment?.

Posted: Fri, 08 Jul 2022 17:05:56 GMT [source]

The beans are roasted, cracked, and deshelled, resulting in pieces called nibs, which are ground into a thick paste known as chocolate liquor or cocoa paste. The liquor is processed into chocolate by adding cocoa butter, sugar, and sometimes vanilla and lecithin. Alternatively, cocoa powder and cocoa butter can be separated using a hydraulic press or the Broma process. Treating cocoa with an alkali produces Dutch process cocoa, which has a different flavor profile than untreated cocoa.

How to Trade Cocoa in 2023: These are Your Choices (+ Brokers in Your Country)

Since that ‘proud moment’ I have been managing trading.info for over 10 years. After my studies business administration and psychology, I decided to put all my time in developing this website. It is important to know the differences when investing in cocoa, because they both have different features and volatility. Hard commodities are dependent on natural supply whereas soft commodities are much more dependent on human beings.

If you want to play the cocoa market, it is best to trade cocoa futures contracts. The contract is offered on the London International Financial Futures and Options Exchange, which is a part of the Intercontinental Exchange . It also trades on the New York Mercantile Exchange — a member of the Chicago Mercantile Exchange Group.

When, during the 19th century, the middle classes rose up against the nobility, drinking chocolate was initially forgotten. It was not until the industrial revolution that cocoa and products produced from it enjoyed a resurgence in popularity. Assessment of the movements of global supply and demand, reviewing in detail the developments in the world cocoa market during the past ten years. When the pound weakens, the price of cocoa becomes more expensive on the London futures market.

Intraday data delayed at least 15 minutes or per exchange requirements. Cocoa Beans Market Trend for Development and marketing channels are analysed. Finally, the feasibility of new investment projects is assessed and overall research conclusions offered.

Cocoa futures traded on the ICE Futures US Softs exchange, are valued at 10 Tonnes per contract with a tick size of 1 and tick value of US$10. Shipment in bags, either in a ship’s hold or in containers, is still common. A typical pod contains 30 to 40 beans and about 400 dried beans are required to make 1 pound of chocolate.

Add International Cocoa Organization to your Homescreen!

With roughly 60% of the world’s cocoa supply coming from the Ivory Coast and Ghana, the weather patterns in these countries can have a strong impact on the price of cocoa. Strong storms sometimes hit the area, which squeezes supply as farmers have difficulty bringing their cocoa crop to port. Demand for chocolate is also a large driver of cocoa prices and holidays typically see increased demand.

See full non-independent research disclaimer and quarterly summary. After you have opened your position – attaching the appropriate stops and limits – it is important to monitor your position’s progress and to keep up to date with anything that could impact the price of cocoa. All trading involves risk, especially if you’re trading using leverage, which is why you need a risk management strategy to protect against unnecessary losses.

Dubai set to become a global hub for cocoa trade – ConfectioneryNews.com

Dubai set to become a global hub for cocoa trade.

Posted: Wed, 26 May 2021 07:00:00 GMT [source]

Brazil269,731World5,756,953In 2020, world production of cocoa beans was 5.8 million tonnes, led by Ivory Coast with 38% of the total. Secondary producers were Ghana and Indonesia (each with about 14%). The Nacional is a rare variety of cocoa bean found in areas of South America such as Ecuador and Peru. Pure genotypes of the bean are rare because most Nacional varieties have been interbred with other cocoa bean varieties. Ecuadorian Nacional traces its genetic lineage as far back as 5,300 years, to the earliest-known cacao trees domesticated by humanity. In the 18th and 19th centuries, Nacional was considered by many European chocolatiers to be the most coveted source of cacao in the world due to its floral aroma and complex flavor profile.

In 2021, the market was growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon. On the date of publication, Rich Asplund did not have positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. As published in the latest issue of the ICCO Quarterly Bulletin of Cocoa Statistics , these data are collected in numerous ways, primarily by sending questionnaires to countries .

What is the specification for the cocoa futures contract?

A systematic review presented moderate evidence that the use of flavanol-rich chocolate and cocoa products causes a small blood pressure lowering effect in healthy adults—mostly in the short term. Treating with an alkali produces Dutch process cocoa, which is less acidic, darker, and more mellow in flavor than untreated cocoa. Regular (non-alkalized) cocoa is acidic, so when cocoa is treated with an alkaline ingredient, generally potassium carbonate, the pH increases. This process can be done at various stages during manufacturing, including during nib treatment, liquor treatment, or press cake treatment. Trinitario originated in Trinidad after an introduction of Forastero to the local Criollo crop.

Cocoa trading increases throughout the 1800s and 1900s in line with growing chocolate consumption. The most important producers of cocoa are the Ivory Coast, Ghana, Malaysia and Brazil. Cocoa is imported primarily by rich industrialised countries such as the USA and Europe. Final Report will add the analysis of the COVID-19 and Russia Ukraine war impact on this industry. This website is using a security service to protect itself from online attacks.

The content on this website is provided for informational purposes only and isn’t intended to constitute professional financial advice. Trading any financial instrument involves a significant risk of loss. Commodity.com is not liable for any damages arising out of the use of its contents.

To enter into a transaction with the https://1investing.in/’s Clearing House, a broker must deposit a specified amount of money to guarantee his or her commitment to the terms of the contract. This money is called “initial margin”, and is a small proportion (i.e. 2%-10%) of the total value of the contract. Once a contract is open, the position is “marked to the market” daily. If the futures position loses value (i.e., if the market moves against it – e.g., the trader is long and the market goes down), the amount of money in the margin account will decline accordingly.

Today, civilizations all around the world enjoy cocoa in thousands of different ways. With the annual consumption of cocoa beans over 4.5 million tons, cocoa is an important commodity in world markets. Gold and silver are available in smaller quantities and the supply has a direct impact on the market.

The Russian invasion of Ukraine will probably decrease the consumption of goods like chocolate and coffee as there will be restrictions on travel and airports where most of the sales occur. This follows a time when the demand for chocolate and coffee is still recovering from the COVID-19 pandemic. Additionally, farmers worry that the continuous lack of rains in the top growing regions of the Ivory Coast will damage the quality of beans and could reduce the size of the April-to-September mid-crop. Cocoa contributes significantly to Nigerian economic activity, comprising the largest part of the country’s foreign exchange, and providing income for farmers.