What’s the Difference Between a Debtor and a Creditor?

To mitigate risk, most creditors tie interest rates or fees to the borrower’s creditworthiness and past credit history. Borrowers with good credit scores are considered low-risk to creditors, and these borrowers often garner low-interest rates. Sometimes it is possible to attach the debtor’s property, wages, or bank account as a means of forcing payments (see garnishment). Debtor and creditor, relationship existing between two persons in which one, the debtor, can be compelled to furnish services, money, or goods to the other, the creditor. Secured creditors provide loans only if the debtors are able to pledge a specific asset as collateral. In case of a debtor’s bankruptcy, a secured creditor can seize the collateral from the debtor to cover the losses from the unpaid debt.

Act could give greater protection to people in debt – Jamaica Observer

Act could give greater protection to people in debt.

Posted: Fri, 07 Jul 2023 07:00:00 GMT [source]

There are many different ways that you can manage your company’s debtors. Firstly, you should improve your accounts receivable process so that you’re able to recover your outstanding payments as quickly as possible. Think about offering positive incentives for early payment and streamlining the invoice workflow.

Can Debtors Go to Jail for Unpaid Debts?

A wise money habit is to avoid taking on unnecessary debt that you can’t comfortably repay. For example, piling up credit card debt with everyday purchases can strain your budget and make it difficult to keep up with your monthly payments. Additionally, increasing your debt could negatively impact your credit score. Creditors can include friends or family that you borrow money from and have to pay back.

They tend to raise their rates when they want to bring more money in. Home-equity lines of credit and adjustable-rate mortgages — which each carry variable interest rates — generally rise within two billing cycles after a change in the Fed’s rates. The average rate on a home-equity loan was 8.47 percent as of July 19, according to Bankrate.com, up from 5 percent a year ago. When a bank acts as the counterpart to a debt arrangement, the debtor is usually referred to as a borrower.

Interested in automating the way you get paid? GoCardless can help

For an efficient Working Capital cycle, every company maintains a time lag between the receipt from debtors and payment to creditors. Investors use credit ratings to assess the risk profile of companies and governments when they raise financing in debt capital markets. Generally, the lower a borrower’s rating, the higher its financing costs.

- Also, exploring your pre-approval options might help you make informed financial decisions.

- Purchasing and selling goods or services for credit changes the relationship between a seller and buyer to a Creditor vs Debtor.

- These are economic resources that are owned by the business and can be measured in monetary terms.

- You can also visit AnnualCreditReport.com to learn how to get free copies of your credit reports.

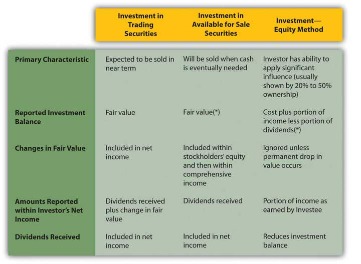

In accounting reporting, creditors can be categorized as current and long-term creditors. The debts are reported under current liabilities of the balance sheet. Debts of long-term creditors are due more than one year after and are reported under long-term liabilities. In financial reporting, debtors are generally classified according to the length of debt repayments.

Understanding Creditors

I’m a wordsmith with a penchant for puns and making complex subjects accessible. Encyclopaedia Britannica’s editors oversee subject areas in which they have extensive knowledge, whether from years of experience gained by working on that content or via study for an advanced degree. They write new content and verify and edit content received from contributors. It’s also a good idea to avoid borrowing too much or borrowing in situations where it might negatively affect your budget and financial plan. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

NOTICE TO DEBTORS AND CREDITORS ESTATE OF CHARLES … – Fayette County News

NOTICE TO DEBTORS AND CREDITORS ESTATE OF CHARLES ….

Posted: Tue, 25 Jul 2023 23:16:00 GMT [source]

For medium and large enterprises, paying all transactions in cash is unheard of. Individuals often rely on credit scores to obtain loans and extensions of credit. Tax debts and child support typically rank highest along with criminal fines, and overpayments of federal benefits for repayment. Unsecured loans such as credit cards are prioritized last, giving those creditors the smallest chance of recouping funds from debtors during bankruptcy proceedings. This process often involves screening a borrower’s financial information—like their current debts, income and credit history.

What Happens If Creditors Are Not Repaid?

The FDCPA is a consumer protection law, designed to protect debtors. This act outlines when bill collectors can call debtors, where they can call them, and how often they can call them. It also emphasizes elements related to the debtor’s privacy and other rights.

The first part is referred to as the creditor, who is the one who has lent money, goods, or services. Scoring companies such as FICO calculate your credit score using data from your credit report, including your current and past credit accounts, your record of making payments, the status of your accounts and so on. Chapter 11 is a form of bankruptcy that involves the reorganization of a debtor’s business affairs, debts, and assets and allows a company to stay in business and restructure its obligations. While creditors lend money and are owed that money, a debt collector does not lend money. A creditor is the original lender because they made the loan to you. Debt collectors purchase delinquent loans from the original creditor, such as a bank, usually at a discount, and aim to then collect on that loan.

However, bankruptcy laws and rules can widely vary among different jurisdictions. Creditors – In day-to-day business, a person or a legal body to whom money is owed is known as a creditor. For a business, the amount to be paid may arise due to repayment of a loan, goods purchased on credit, etc. Then the former company will be debtor while the latter company is the creditor. They are the two parties to a particular transaction and hence there should not be any confusion regarding these two anymore.

Keep in mind that it might impact your financial situation if someone who owes you money defaults on their end of the agreement. If you pay the loan in full, you’ll receive the deed and own the property outright. If you refinance the debt, your new creditor will pay off the original loan, and the original creditor will transfer the deed to the new one. If you sell the home, the buyer will pay off your loan with cash or a loan of their own, at which point your creditor will transfer the deed to the buyer or their creditor.

What Is the Difference Between Credit and Debt?

This has been a guide to the top difference between creditor vs Debtor Here we also discuss the Creditors vs Debtors key differences with infographics and comparison table. The main advantage of the debtors is that they can help increase the business’s sales. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether.

But the country’s latest debt ceiling standoff have reinforced genuine concerns that the U.S could default for the first time. Tax cuts and government free r&d tax credit calculator spending have led to widening government deficits in recent years. And with rising interest rates, the cost of bridging that gap has increased.

- They write new content and verify and edit content received from contributors.

- In contrast, borrowers with low credit scores are riskier for creditors and are often charged higher interest rates to address that risk.

- If you owe money to a person or business for goods or services that they have provided, then they are a creditor.

- The Fair Debt Collection Practices Act (FDCPA) established ethical guidelines for the collection of consumer debts by creditors.

The party to whom the money is owed might be a supplier, bank, or other lender who is referred to as the creditor. For the creditor, the money owed to them (by a debtor) is considered an asset. In some cases, money owed by a debtor can be an account receivable (for goods or services bought on credit) or note receivable if it’s a loan. If a debtor fails to pay a debt, creditors have some recourse to collect it. If the debt is backed by collateral, such as mortgages and car loans backed by houses and cars, the creditor can attempt to repossess the collateral. In other cases, the creditor may take the debtor to court in an attempt to have the debtor’s wages garnished or to secure another type of repayment order.