What is Accrued Income? Learn Accrued Income Meaning & Examples

A dozen units of soap were shipped on July 30th but will be delivered to the customer on August 6th. The order is not prepaid, so the customer will pay only after the goods are delivered. Some accrual policies have the ability to carry over or roll over some or all unused time that has been accrued into the next year. If the accrual policy does not have any type of rollover, any accrued time that is in the bank is usually lost at the end of the employer’s calendar year. In many cases[citation needed], these guidelines indicate there is a trial period (usually 30 to 90 days) where no time is awarded to the employee.

Certain sectors are more likely to use accrued revenue than other industries are. For instance, companies who are in the field of service typically use accrued revenue closing entry definition since they usually contract with clients that span multiple accounting periods. Accrued revenue demonstrates the performance of a business in the long run.

Green Housing is a real estate company that builds and rents houses both for commercial and residential use. Depending on the contracts, tenants may pay their rents monthly, quarterly, mid-yearly, or yearly. In the contract, Green Housing recognizes that Mr. Jack will pay at the end of the year – after he has used the house.

Subscribe to be notified of new content on MarketSplash.

At the beginning of January, the company has 100 customers who have signed up for the service and pay on a monthly basis. At the end of January, the company has provided the service for the month but has not yet received payment from the customers. For example, a company might provide consulting services to a client in December, but not issue an invoice until January of the following year. In this case, the company would record the revenue as “accrued” in December and recognize it as “received” in January, when the invoice is paid. Recording accrued revenue as a part of accrual accounting can help a business be agile by anticipating expenses and revenues in real-time.

When the customer receives the invoice, the accrued revenue account is debited. In addition, noncurrent assets are recorded at their cost, regardless of when the money is received. This accounting principle aims to track income and expenses consistently regardless of when the cash is received.

- Under the contract terms, the business may agree to deliver the service at the price of $1,000 and send an invoice at the end of the month, which is payable on the 15th of the next month.

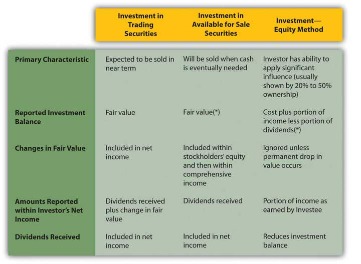

- Deferred revenue, on the other hand, is income received from sales transactions but not yet earned by delivering goods or services.

- For example, in the US, taxpayers are exempt from using accrual accounting if average annual gross receipts of the preceding three years does not exceed $25m.

- “Accruals are often reported as part of trade and other payables, whereas provisions are reported separately.”

Accrued income is the money a company has earned in the ordinary course of business but has yet to be received, and for which the invoice is yet to be billed to the customer. Deferred revenue, on the other hand, is income received from sales transactions but not yet earned by delivering goods or services. The reason companies need to report revenue this way is to ensure that the reported financial results provide an accurate representation of a company’s monthly revenue generation. Generally, companies should recognize accrued revenue when they have performed the services they were obligated to do or delivered the goods they agreed to provide.

Origin of accrued income

Recording accrued income is important because it allows companies and individuals to track their income more accurately. Also, if a company or individual decides to terminate a contract early, they will still have to pay for the services or goods that were already provided. Regarding accrued revenues, revenue journal entries require a credit to the revenue account with a corresponding debit to accrued revenue. It is money that has been earned but not yet received in cash or recorded on an invoice. This means that if a company has already provided its services or products and the customer is only waiting to pay for them, it can report this as an accrued revenue on its balance sheet. Accrued revenue is earned revenue (i.e., the company is entitled to receive it at some point in the future).

Companies are required to anticipate the percentage of accounts receivables that will go unpaid based on historical losses. This number is called the allowance for doubtful accounts, and it is netted out of the accounts receivable account on the balance sheet. At the end of March, ABC has earned one month’s worth of interest on its investment – but it will not actually receive an interest payment until September 1st. The month’s worth of interest – approximately $166 – that ABC has earned but not received at the end of March is accrued interest income. The cost of adding two more users and a training session is not billed immediately to the ABC agency but is marked as Yoohoo’s accrued revenue for that month. This revenue will be converted to accounts receivable during the renewal in the next quarter.

As a result, you have to create an accrued revenue journal entry twice throughout the project– one for each milestone. If the crane had been rented for two months, United would issue an invoice to the customer at the end of each month but still recognize the revenue each day. Debit balances related to accrued revenue are recorded on the balance sheet, while the revenue change appears in the income statement. Another example of accrued revenue is when a subscription box company bills customers monthly for subscriptions that aren’t delivered yet. A subscription box company may bill its customers monthly for rent or insurance.

Regardless of whether company ABC will bill for the service after each milestone or at the end of the year, it will count as accrued revenue. However, in the books of accounts of client Y, the same will be recorded as accrued expenses. The accrued income term is sometimes also applied to revenue for which an entity has not yet issued a billing, and for which it has not yet been paid. This is a common occurrence in the services industry, where a project may involve billable services for several months, with an invoice only being issued at the end of the project. In this scenario, the concept is more commonly referred to as accrued revenue.

Which of these is most important for your financial advisor to have?

“Accruals are often reported as part of trade and other payables, whereas provisions are reported separately.” Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Small Company makes an investment of $40,000 in Big Company on 1 July 2016.

What to Know About Paying Taxes on CD Interest – The Tech Edvocate

What to Know About Paying Taxes on CD Interest.

Posted: Mon, 04 Sep 2023 19:42:59 GMT [source]

The term “on account” means that customers make the purchase on credit. In such situations, companies recognize that they are selling goods or performing a service even when they haven’t received any cash. Another concept similar to accrued revenue that you should be familiar with is deferred revenue. Such revenue occurs when a client pays you upfront for goods and services you are yet to deliver.

Invoice the customer

For example, purchasing goods from a supplier is an accrued expense until you pay the invoice. Most businesses accrue revenue and expenses as a part of their standard operations. In verticals like construction, firms earn most of their income as accrued revenue. Conversely, a standard brick-and-mortar retailer accrues expenses when they receive new inventory before an invoice. Because accrued revenue can have a significant impact on a business’s financial statements, it’s important to track and record it accurately.

Accrued Income in accounting is a crucial concept representing a company’s income during a specific period that it is yet to receive or invoice the customer. Individual investors aren’t the only ones that can earn accrued income. Accrual accounting is an accounting method used by companies when they handle accrued income. The accrued income is recorded on an income statement, regardless of whether the company received it or not.

Your accrued income is your interest, so you can view it as a bank account. Accrued revenue is an account receivable for goods and services provided to clients. The majority of the time, when we think of accounting, we are thinking of the method of accounting based on cash which records revenue when cash is received, and expenditures are recorded as bills get paid.

- However, the company using the product or service will record it as an accrued expense, which is a liability.

- In this scenario, the buyer receives a sum of money that represents the value of the total amount of the order, and the supplier awaits payment.

- Pied Piper IT Services agrees to build a flight navigation software for XYZ airlines in 12 months for a sum of $120,000.

- But the fact remains that John has already earned interest for 6 months by 31 December 2019.

- The company recognizes the proceeds as a revenue in its current income statement still for the fiscal year of the delivery, even though it will not get paid until the following accounting period.

The funds received are then recorded as deferred revenue until the goods or services have been delivered and the income can be recognized as revenue. By properly accounting for accrued revenues, businesses can ensure accuracy in their financial records and provide investors with transparent information about the company’s performance. While accrued revenue doesn’t create problems in itself, businesses need to account for this lack of cash flow in financial statements. If a company fails to adjust for accrued revenues, it risks accounting errors and a lower ROI.

Managing revenue and expense types

This does not prevent an employee from calling in sick immediately after being hired, but it does mean that they will not get paid for this time off. However, it does prevent an employee, for example, scheduling a vacation for the second week of work. After this trial period, the award of time may begin or it may be retroactive, back to the date of hire. Within these guidelines, the rate at which the employee will accumulate the vacation or sick time is often determined by length of service (the amount of time the employee has worked for the employers). A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.